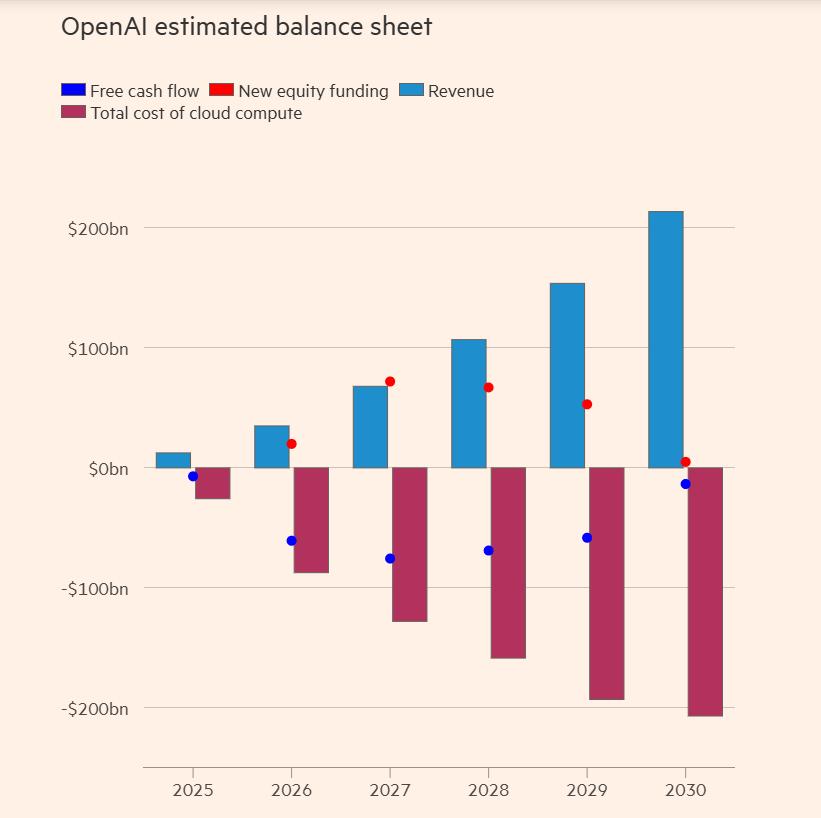

On November 27, it was reported that HSBC warned in its latest research report that even with explosive revenue growth by 2030, OpenAI will still face a funding gap of at least $207 billion.

This figure not only highlights the soaring infrastructure costs and the intensifying market competition but also triggers profound concerns in the market about the sustainability of the entire AI ecosystem. Can this technology trend, characterized by soaring demand and unprecedented capital intensity, continue to operate smoothly?

Sky-High Computing Power Demand: The AI Foundation Built on Huge Leasing Contracts

The industry playfully describes OpenAI’s operational model as “a money-burning bottomless pit with a website as its facade,” and the demand for computing power is the direct cause of its financial black hole.

HSBC’s U.S. software and services team updated its evaluation model for OpenAI, incorporating two key pieces of data: the 250 billion cloud computing resource leasing agreement that OpenAI signed with Microsoft in late October and the38 billion cloud services contract it reached with Amazon. These two major deals have boosted OpenAI’s total contracted computing power to 36 gigawatts.

Of 1.8trillion,OpenAIwillneedtopayapproximately620 billion annually in data center leasing fees in the future. What is concerning is that only about one-third of the contracted computing power is expected to be actually put into operation during this period.

According to the report, from this year to 2030, OpenAI’s cumulative leasing costs will reach 792 billion. Looking ahead to 2033,the total computing investment commitment scould soar to1.4 trillion, a figure that coincides with the eight-year investment plan previously disclosed by OpenAI’s CEO, Sam Altman.