According to Saxo Markets, stock investors looking to capitalize on the red-hot artificial intelligence theme should look to Asia, where valuations for U.S. tech companies have become stretched.

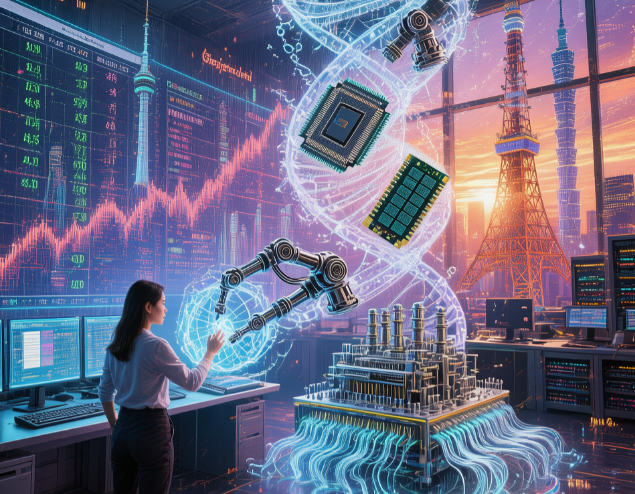

“Asia offers a cheaper and more earnings-anchored path into the same mega-trend,” Charu Chanana, Saxo’s chief investment strategist in Singapore, wrote in a report. “Roughly 70% of global chip manufacturing, 90% of AI memory, and nearly all advanced packaging capacity are located in Taiwan, South Korea, and Japan, making the region indispensable to the AI ecosystem.”

She added that in contrast, U.S. tech stocks are trading at high valuations, with companies facing various risks such as concentration and closed-loop dynamics. Data shows that the S&P 500 Information Technology Index trades at a forward price-to-earnings ratio of nearly 30, compared with 17 for the MSCI Asia Pacific Information Technology Index. Saxo’s comments come as concerns grow among investors about the lofty valuations of some of the biggest AI winners, particularly U.S. innovation leaders like Nvidia. Recently, a wave of closed-loop trading involving OpenAI, Nvidia, and other AI-focused firms has further fueled worries that the AI boom may be artificially inflated.

Chanana wrote in the report that although Asia-based AI-related companies also face “global cyclical risks,” they offer better earnings visibility due to significant capital spending flowing into Asian supply chains for AI infrastructure buildout.

She also noted: “The physical expansion of AI infrastructure — chips, servers, data centers — is still full steam ahead, and a large part of that is happening in Asia.”